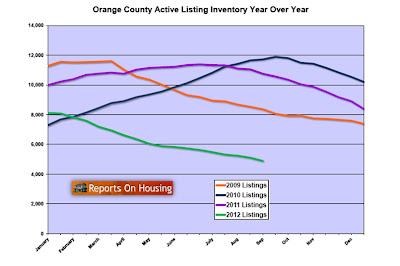

The Orange County inventory has not stopped dropping since June of last year. The inventory beat a record low established in March 2005.

The Orange County active inventory dropped to 4,886 homes, beating a low of 4,912 more than seven years ago. It is fascinating to contrast the incredibly low inventory to the height during the downturn of 17,898 homes in September 2007, more than triple today’s mark. Last year’s height occurred in June with an inventory of 11,388, and it has dropped unabated ever since.

The housing market has become a market of extremes. From the crazy days of mass appreciation, astronomical demand and low inventories from 2000 through 2005, to the Great Recession of 2006* through 2011 with unprecedented depreciation, little demand, and plenty of inventory, the housing market is either on or it is off. There is no in-between, no happy medium. It is either hot or cold, never just right.

For those real estate veterans that have been around for a while, everybody was hoping that housing would morph into a market simple to navigate, good for both buyers and sellers. Sustainable demand along with a manageable inventory would be ideal. Along came 2012 and it was time for an “about face.” If we just read the tea leaves, we would have seen it coming. The continuous drop in the inventory foreshadowed that a change was afoot.

As the inventory dropped to bottom of the barrel levels, interest rates declined to below 4%. Investors caught on first and were already entering the market towards the end of 2011, parking their cash in real estate. They intuitively knew that it was best to buy at a low and real estate was starting to show signs of reaching that low. With low rates and low prices, affordability based upon the median sales price and interest rates reached levels not seen since 1999. Savvy buyers quickly came to the realization that NOW was a great time to buy. From there, the floodgates opened up.

Experts started pointing to a bottom in the market. Warren Buffett exclaimed that he would buy a couple hundred thousand single-family homes if he had the resources to manage that kind of a portfolio. Economists started reevaluating their forecasts and 2012 was all of a sudden looking a lot rosier for housing. But, it just didn’t bottom, a housing recovery was unfolding in many market across the U.S., including Orange County and the rest of Southern California.

From here, expect news of housing appreciation through the rest of 2012. There will be a resurgence in the building industry as building permits skyrocket (inevitable since major earth grading and infrastructure is already well underway throughout the OC). With the media communicating the healing housing market and appreciation, consumer confidence will rise with the knowledge that the “average Joe’s” biggest asset, his home, is moving in the right direction. Housing is the fundamental driver to the eventual healing of the economy as a whole. It has been that way with every modern downturn. Stay tuned…

Demand: As kids heads off to school, demand starts its cyclical slowdown.

The real estate market is transitioning into the Autumn Market. Yes, autumn does not officially begin until the end of September, but it comes early for housing every year. Buyers with kids want to close by the time school begins, so with that window gone, demand starts to slow from the highs of the spring and summer. Demand, the number of new pending sales over the prior month, dropped by 2%, 81 pending sales, and now totals 3,463. That is the highest level for this time of year since I started tracking demand back in 2004, and even exceeds 2009 when the initial first time home buyer tax credit artificially stimulated demand.

Currently, demand is still very close to 2009 numbers, but a major difference is that more short sales are actually closing today compared to back then. It used to be a crapshoot as to whether or not a short sale would ever close. Today, the odds are much more favorable, systems have improved, and short sales are eventually closing.

Last year at this time there were 414 fewer pending sales, a 14% difference. Demand may drop during the Autumn Market, but expect only a slight drop since the inventory is so tight and many buyers have been unsuccessful thus far in their attempts to purchase. For the persistent buyer with a sharp enough pencil and a lot of patience, success is inevitable in time.

By Steven Thomas

By Steven Thomas