1. Know Why Buyers Should Buy Now

There are 5 major reasons purchasers should act now:

Prices will bounce along the bottom this winter. However, projections call for appreciation after that. Prices are expected to increase by 10% over the next 4 years.

With inventory declining in many markets, finding a home of your dreams may become more difficult going forward.

Interest rates are at historic lows.

Rents are skyrocketing.

In the long term, homeownership creates family wealth.

For more detailed information on each of the above points, read our blog post on the subject - 5 Reasons to Buy a Home Now.

2. Don't Be Surprised if Prices Soften Again This Winter

Almost every price index has shown house values increasing over the last several months. Though this has been seen as good news, we must realize that home prices have shown a seasonal adjustment each of the last three years.

In 2009, 2010 and 2011 national prices have risen in the spring and summer only to soften again in the fall and winter. The same is expected to happen this fall and winter. This should come as no surprise and will not be a sign of impending doom.

KCM Members can log in to download quotes, a sensational graph and other visuals from the September edition of KCM. This info will assist you in explaining this issue to your buyers and sellers.

3. Attend Conferences and Classes That Will Help Your Business

We hope to see you in Orlando at the REALTORS Conference & Expo. If you are attending, be sure to check out KCM Founder, Steve Harney, as he delivers his leadership message:

Leadership in the Current Real Estate Environment - (Nov 10 @ 1:30-3PM)

If you can't get to Florida, make sure you take local classes that will enhance your position as a person of knowledge in a rapidly evolving market.

4. We Must Start Building the Foundation for a Great 2013

Happy New Year!! Many of the deals we put into contract from now until the end of the year will actually close in 2013. Almost every buyer we meet and listing we take in the next 3 months will close next year. You are now building your 2013 income.

If you had a successful 2012, great!! Now you must work hard in order to reach your 2013 goals. If 2012 was a challenge, the good news is that it's over. Start building the foundation for a fabulous 2013.

5. We Must Manage Our Expectations Properly

Some of us are judging our daily success by whether or not we did a deal (listing, listing sold, buyer sale) that day. If we did not, we see our effort as futile. We must make sure that we instead define success based on whether we did the activities that success requires.

As an example, if a person is losing weight, they can't judge success by the pounds they lost that day. Instead, they have to judge their success in terms of whether they ate properly and exercised. If they eat wisely and exercise, the weight loss is guaranteed to come. If you do the activities that will create success, your success is likewise guaranteed.

Wednesday, September 26, 2012

Wednesday, September 19, 2012

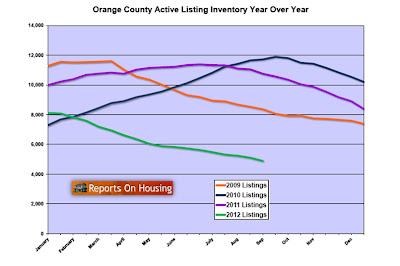

OC Active Inventory

Active Inventory – A Record Low: After reaching a low not seen in more than seven years, the inventory dropped further.

The Orange County active inventory shed an additional 210 homes in the past two weeks, an unprecedented 4% drop for this time of year, and now totals 4,676. It is extraordinary because there is almost nothing on the market. Ask any seasoned buyer and they will fill you in on their real estate adventures. They have written offer after offer after offer, only to be told again and again that their offer was not good enough. There simply are not enough homes to go around.

Last year at this time there were 10,556 homes on the market, more than double. The active inventory stood at 8,114 homes at the beginning of the year, 3,438 more than today.

Typically during this time of year, unrealistic homeowners that were unable to sell during the best time of the year, both the Spring and Summer markets, opt to throw in the towel and pull their homes off of the market. But, with such a limited inventory, expect fewer homes to venture down this path. The listing inventory will hit a bottom eventually. It should be soon; however, this year has been the year of unconventional wisdom.

Demand: The Autumn Market is here, along with another drop in demand.

The Summer Market is now in the rear view mirror. It has been replaced with the changing of the leaves, the structure of school, and, very soon, the howls of “trick or treat.” Typical for this time of year, there is a slight deceleration in demand, the number of pending sales over the prior month. In the past month, demand has dropped by 6%, 214 pending sales, and now sits at 3,330. Last year at this time there were 385 fewer pending sales, a 13% difference. Of course, if more homes were placed on the market, buyers that have been anxiously waiting for an increase in fresh inventory would finally be able to purchase. Today’s sparse inventory is actually hurting demand. There are plenty of willing and able buyers, just not enough homes.

Steven Thomas

Quantitative Economics and Decision Sciences

Tuesday, September 18, 2012

Foreclosures are Now Only a Tiny Part of the OC Market

Foreclosure Reality: Only 8% of closed sales in August were foreclosures.

Unbelievably, everybody is under the impression that the housing market is flooded with foreclosures. Just about every buyer that hops into a REALTOR’s® car for the first time is anticipating seeing a deluge of homes taken back by the bank. They are also expecting an incredible deal, after all, isn’t the economy still hemorrhaging?

It is time for a reality check. First, it is no longer a buyer’s market. The expected market time for foreclosures is only 20 days; and, for the market as a whole in Orange County, it is 42 days. Compare that to 54 days for foreclosures and 3.6 months for the entire market in September of last year. The Orange County housing market is HOT. Multiple offers, purchase prices close to, or even above, their asking prices, and cash buyers are the norm.

Steven Thomas

Quantitative Economics and Decision Sciences

Unbelievably, everybody is under the impression that the housing market is flooded with foreclosures. Just about every buyer that hops into a REALTOR’s® car for the first time is anticipating seeing a deluge of homes taken back by the bank. They are also expecting an incredible deal, after all, isn’t the economy still hemorrhaging?

It is time for a reality check. First, it is no longer a buyer’s market. The expected market time for foreclosures is only 20 days; and, for the market as a whole in Orange County, it is 42 days. Compare that to 54 days for foreclosures and 3.6 months for the entire market in September of last year. The Orange County housing market is HOT. Multiple offers, purchase prices close to, or even above, their asking prices, and cash buyers are the norm.

Second, the number of foreclosures has been steadily dropping. In August, 8% of all sales were foreclosures. Compare that to 15% last year and 44% at the height of foreclosure activity in January 2009. Ever since August 2009, there have been more closed short sales (homes that sell for less than the total outstanding loans) than foreclosures. The gap between the two has been widening. 23% of all closed sales in August were short sales and it was 22% in 2011. As foreclosures have been dropping, the number of equity sellers (a fancy term REALTORS® use to describe regular good ol’ fashioned homeowners with equity in their homes) has been progressively increasing. 68% of all August sales were equity sellers, over two-thirds. It was close to two-thirds distressed in January 2009 with 63% of all sales either a foreclosure or short sale..

The market has come a long way and is in the midst of a recovery. How do foreclosures fair today? They are snapped up like ice cold lemonade during a heat wave. The sales price to list price ratio for foreclosures last month was an eye-popping 103%. That means that, on average, foreclosures closed 3% above their asking prices. A foreclosure listed at $500,000 sold for $515,000.

If a buyer wants to purchase a foreclosure in today’s market, they better bring along a very sharp pencil and a winning strategy to beat out the horde of buyers interested in the same home. There is so much interest that many foreclosures receive upwards of 20 offers. It is common for homes to be pulled off of the active market in order to sift through the torrent of offers. Buyers that like to gamble will enjoy the rush of pursuing a foreclosure. For everybody else, the pursuit of these homes is frustrating and very often a waste of time and energy.

The market has come a long way and is in the midst of a recovery. How do foreclosures fair today? They are snapped up like ice cold lemonade during a heat wave. The sales price to list price ratio for foreclosures last month was an eye-popping 103%. That means that, on average, foreclosures closed 3% above their asking prices. A foreclosure listed at $500,000 sold for $515,000.

If a buyer wants to purchase a foreclosure in today’s market, they better bring along a very sharp pencil and a winning strategy to beat out the horde of buyers interested in the same home. There is so much interest that many foreclosures receive upwards of 20 offers. It is common for homes to be pulled off of the active market in order to sift through the torrent of offers. Buyers that like to gamble will enjoy the rush of pursuing a foreclosure. For everybody else, the pursuit of these homes is frustrating and very often a waste of time and energy.

Steven Thomas

Quantitative Economics and Decision Sciences

Thursday, September 13, 2012

Low Housing Supply Raises Concerns

Local experts fear it could keep market from making progress

Lack of housing inventory to feed consumer demand is a growing concern in San Diego County and statewide, a chief housing economist told local Realtors on Friday. Real estate pros fear this dynamic could keep the housing market from making progress because qualified buyers are edging each other out of slimmer pickings.

Leslie Appleton-Young, with the California Association of Realtors, said competition for homes began to heat up earlier this year in light of declining foreclosure resales and increased investor activity. The result, she said, has been increases in both sales and prices statewide, though we are still far from pre-recession peaks.

“The market is in the process … of healing,” she told local real estate pros at a housing summit held by the San Diego Association of Realtors. The event’s other keynote speakers — Gary London, with The London Group Realty Advisors, and Lawrence Yun, chief economist at the National Association of Realtors — echoed similar thoughts about inventory and the fact that California is in the middle of a tepid recovery.

Appleton-Young broke down housing inventory into three key categories, all very different from each other: equity, bank-owned and short sales.

“Equity” sales, or traditional sales, now make up almost 60 percent of total statewide home sales, up from 30 percent in January 2009, Appleton-Young’s numbers show. The share of bank-owned properties in the market has fallen from 60 percent three years ago to 20 percent now. And lastly, short sales, a process more lenders have now streamlined, are up.

This shift in the sales makeup indicates an increased demand in inventory, a higher presence of investors and a lack of distressed homes hitting the for-sale market. In other words, more potential buyers are competing for fewer homes, which can keep the market from moving forward, or at a standstill, speakers said.

London and Yun highlighted San Diego’s lack of housing construction due to an issue that’s specific to this county.

“You’re running out of land,” said Yun, who added that new-home construction has hit a 50-year low nationwide.

London said the age of traditional subdivision construction is over, pushing homebuilders toward going vertical and building in smaller batches.

The lack of inventory and the county’s population growth will help push up prices, though the escalation will not be as rapid as in pre-recession days, London said.

Written by

Lily Leung

Lack of housing inventory to feed consumer demand is a growing concern in San Diego County and statewide, a chief housing economist told local Realtors on Friday. Real estate pros fear this dynamic could keep the housing market from making progress because qualified buyers are edging each other out of slimmer pickings.

Leslie Appleton-Young, with the California Association of Realtors, said competition for homes began to heat up earlier this year in light of declining foreclosure resales and increased investor activity. The result, she said, has been increases in both sales and prices statewide, though we are still far from pre-recession peaks.

“The market is in the process … of healing,” she told local real estate pros at a housing summit held by the San Diego Association of Realtors. The event’s other keynote speakers — Gary London, with The London Group Realty Advisors, and Lawrence Yun, chief economist at the National Association of Realtors — echoed similar thoughts about inventory and the fact that California is in the middle of a tepid recovery.

Appleton-Young broke down housing inventory into three key categories, all very different from each other: equity, bank-owned and short sales.

“Equity” sales, or traditional sales, now make up almost 60 percent of total statewide home sales, up from 30 percent in January 2009, Appleton-Young’s numbers show. The share of bank-owned properties in the market has fallen from 60 percent three years ago to 20 percent now. And lastly, short sales, a process more lenders have now streamlined, are up.

This shift in the sales makeup indicates an increased demand in inventory, a higher presence of investors and a lack of distressed homes hitting the for-sale market. In other words, more potential buyers are competing for fewer homes, which can keep the market from moving forward, or at a standstill, speakers said.

London and Yun highlighted San Diego’s lack of housing construction due to an issue that’s specific to this county.

“You’re running out of land,” said Yun, who added that new-home construction has hit a 50-year low nationwide.

London said the age of traditional subdivision construction is over, pushing homebuilders toward going vertical and building in smaller batches.

The lack of inventory and the county’s population growth will help push up prices, though the escalation will not be as rapid as in pre-recession days, London said.

Written by

Lily Leung

Wednesday, September 12, 2012

Fewer S.D. Homeowners Underwater

Zillow reports local rate of 33.9 percent is still above national rate.

The share of San Diego homeowners who are underwater on their mortgages has fallen, but the local rate is still higher than the nation’s, according to a report by real estate website Zillow released Thursday.

More than one-third of local borrowers — 33.9 percent — owed more on their homes than their properties are worth in the second quarter (April to June,) down from 35.6 percent in the first quarter.

The national rate also fell. The share of borrowers with negative equity was 30.9 percent in the second quarter, down from 31.4 percent in the first quarter.

Zillow’s economist Stan Humphries points to rising home prices as the reason for the drop in the underwater borrowers. San Diego home prices are at a four-year high, DataQuick numbers show.

San Diego has a lower negative-equity rate than Las Vegas, Atlanta, Orlando, Phoenix and Riverside, areas that topped Zillow’s 30-city rankings for the second quarter.

Zillow, an online real estate information company, used loan data from TransUnion to draw its conclusions.

Written by

Lily Leung

The share of San Diego homeowners who are underwater on their mortgages has fallen, but the local rate is still higher than the nation’s, according to a report by real estate website Zillow released Thursday.

More than one-third of local borrowers — 33.9 percent — owed more on their homes than their properties are worth in the second quarter (April to June,) down from 35.6 percent in the first quarter.

The national rate also fell. The share of borrowers with negative equity was 30.9 percent in the second quarter, down from 31.4 percent in the first quarter.

Zillow’s economist Stan Humphries points to rising home prices as the reason for the drop in the underwater borrowers. San Diego home prices are at a four-year high, DataQuick numbers show.

San Diego has a lower negative-equity rate than Las Vegas, Atlanta, Orlando, Phoenix and Riverside, areas that topped Zillow’s 30-city rankings for the second quarter.

Zillow, an online real estate information company, used loan data from TransUnion to draw its conclusions.

Written by

Lily Leung

Friday, September 7, 2012

Is Upturn In Home Prices Coming Too Fast For Case-Shiller?

As Wall Street prepares for today's report on housing sales prices, some experts argue that the gold-standard index for tracking the market may be falling behind the times.

Are higher asking prices unrealistic, or is Case-Shiller compiled too slowly to catch the turn? And do higher asking prices signal an approaching return to mid-single-digit annual appreciation, after housing's 33% tumble since 2006?Standard & Poor's Case-Shiller index for home sales closed in June is expected to show a 1.5% decline from this time last year and a seasonally adjusted gain of 0.1% from May, according to Moody's Analytics. But data compiled by sites such as Trulia.com suggest asking prices are now rising faster.

"It suggests that we'll continue to see increases in the Case-Shiller at least through September, which will be the sales they report in November," Trulia chief economist Jed Kolko said.

Case-Shiller's data are relatively slow for two reasons. The homes it reports on have to be sold. Second, the laborious process of compiling data from top markets to calculate the national index takes long enough that June figures are just coming out. Prices for those homes may have been set as long ago as March or April. Case-Shiller's authors think that's a worthy tradeoff for greater accuracy, says David Blitzer, chairman of the index committee at S&P Dow Jones Indices.

In the meantime, asking prices rose 1.2% in the three months that ended in July, compared with the prior three months, according to Trulia. They climbed 4% or more in at least 10 markets, including Birmingham, Ala., and Omaha.

Opinion is divided over whether this can last.

Realogy, parent company of Coldwell Banker and Century 21, said Aug. 7 that July sales prices rose by "mid-single digits," which it expects to last through year's end. At HomeServices of America, the second-biggest national realty firm, executives said higher asking prices are sticking in many markets.

But the jump may prove premature, said Stan Humphries, chief economist at Zillow.com.

Slower job growth in the second quarter, plus expectations of slower second-half expansion and federal budget austerity next year, could scare buyers, he said. And a shortage of lower-price homes for sale may be inflating asking prices, he added.

"I hesitate to say, 'Don't look at (asking prices),' but a lot is going on," he said.

Are higher asking prices unrealistic, or is Case-Shiller compiled too slowly to catch the turn? And do higher asking prices signal an approaching return to mid-single-digit annual appreciation, after housing's 33% tumble since 2006?Standard & Poor's Case-Shiller index for home sales closed in June is expected to show a 1.5% decline from this time last year and a seasonally adjusted gain of 0.1% from May, according to Moody's Analytics. But data compiled by sites such as Trulia.com suggest asking prices are now rising faster.

"It suggests that we'll continue to see increases in the Case-Shiller at least through September, which will be the sales they report in November," Trulia chief economist Jed Kolko said.

Case-Shiller's data are relatively slow for two reasons. The homes it reports on have to be sold. Second, the laborious process of compiling data from top markets to calculate the national index takes long enough that June figures are just coming out. Prices for those homes may have been set as long ago as March or April. Case-Shiller's authors think that's a worthy tradeoff for greater accuracy, says David Blitzer, chairman of the index committee at S&P Dow Jones Indices.

In the meantime, asking prices rose 1.2% in the three months that ended in July, compared with the prior three months, according to Trulia. They climbed 4% or more in at least 10 markets, including Birmingham, Ala., and Omaha.

Opinion is divided over whether this can last.

Realogy, parent company of Coldwell Banker and Century 21, said Aug. 7 that July sales prices rose by "mid-single digits," which it expects to last through year's end. At HomeServices of America, the second-biggest national realty firm, executives said higher asking prices are sticking in many markets.

But the jump may prove premature, said Stan Humphries, chief economist at Zillow.com.

Slower job growth in the second quarter, plus expectations of slower second-half expansion and federal budget austerity next year, could scare buyers, he said. And a shortage of lower-price homes for sale may be inflating asking prices, he added.

"I hesitate to say, 'Don't look at (asking prices),' but a lot is going on," he said.

Monday, September 3, 2012

O.C. Inventory Reaches a Record Low

Record Low Inventory

The Orange County inventory has not stopped dropping since June of last year. The inventory beat a record low established in March 2005.

For those real estate veterans that have been around for a while, everybody was hoping that housing would morph into a market simple to navigate, good for both buyers and sellers. Sustainable demand along with a manageable inventory would be ideal. Along came 2012 and it was time for an “about face.” If we just read the tea leaves, we would have seen it coming. The continuous drop in the inventory foreshadowed that a change was afoot.

As the inventory dropped to bottom of the barrel levels, interest rates declined to below 4%. Investors caught on first and were already entering the market towards the end of 2011, parking their cash in real estate. They intuitively knew that it was best to buy at a low and real estate was starting to show signs of reaching that low. With low rates and low prices, affordability based upon the median sales price and interest rates reached levels not seen since 1999. Savvy buyers quickly came to the realization that NOW was a great time to buy. From there, the floodgates opened up.

Experts started pointing to a bottom in the market. Warren Buffett exclaimed that he would buy a couple hundred thousand single-family homes if he had the resources to manage that kind of a portfolio. Economists started reevaluating their forecasts and 2012 was all of a sudden looking a lot rosier for housing. But, it just didn’t bottom, a housing recovery was unfolding in many market across the U.S., including Orange County and the rest of Southern California.

From here, expect news of housing appreciation through the rest of 2012. There will be a resurgence in the building industry as building permits skyrocket (inevitable since major earth grading and infrastructure is already well underway throughout the OC). With the media communicating the healing housing market and appreciation, consumer confidence will rise with the knowledge that the “average Joe’s” biggest asset, his home, is moving in the right direction. Housing is the fundamental driver to the eventual healing of the economy as a whole. It has been that way with every modern downturn. Stay tuned…

Demand: As kids heads off to school, demand starts its cyclical slowdown.

The real estate market is transitioning into the Autumn Market. Yes, autumn does not officially begin until the end of September, but it comes early for housing every year. Buyers with kids want to close by the time school begins, so with that window gone, demand starts to slow from the highs of the spring and summer. Demand, the number of new pending sales over the prior month, dropped by 2%, 81 pending sales, and now totals 3,463. That is the highest level for this time of year since I started tracking demand back in 2004, and even exceeds 2009 when the initial first time home buyer tax credit artificially stimulated demand.

Currently, demand is still very close to 2009 numbers, but a major difference is that more short sales are actually closing today compared to back then. It used to be a crapshoot as to whether or not a short sale would ever close. Today, the odds are much more favorable, systems have improved, and short sales are eventually closing.

The Orange County inventory has not stopped dropping since June of last year. The inventory beat a record low established in March 2005.

The Orange County active inventory dropped to 4,886 homes, beating a low of 4,912 more than seven years ago. It is fascinating to contrast the incredibly low inventory to the height during the downturn of 17,898 homes in September 2007, more than triple today’s mark. Last year’s height occurred in June with an inventory of 11,388, and it has dropped unabated ever since.

The housing market has become a market of extremes. From the crazy days of mass appreciation, astronomical demand and low inventories from 2000 through 2005, to the Great Recession of 2006* through 2011 with unprecedented depreciation, little demand, and plenty of inventory, the housing market is either on or it is off. There is no in-between, no happy medium. It is either hot or cold, never just right.

For those real estate veterans that have been around for a while, everybody was hoping that housing would morph into a market simple to navigate, good for both buyers and sellers. Sustainable demand along with a manageable inventory would be ideal. Along came 2012 and it was time for an “about face.” If we just read the tea leaves, we would have seen it coming. The continuous drop in the inventory foreshadowed that a change was afoot.

As the inventory dropped to bottom of the barrel levels, interest rates declined to below 4%. Investors caught on first and were already entering the market towards the end of 2011, parking their cash in real estate. They intuitively knew that it was best to buy at a low and real estate was starting to show signs of reaching that low. With low rates and low prices, affordability based upon the median sales price and interest rates reached levels not seen since 1999. Savvy buyers quickly came to the realization that NOW was a great time to buy. From there, the floodgates opened up.

Experts started pointing to a bottom in the market. Warren Buffett exclaimed that he would buy a couple hundred thousand single-family homes if he had the resources to manage that kind of a portfolio. Economists started reevaluating their forecasts and 2012 was all of a sudden looking a lot rosier for housing. But, it just didn’t bottom, a housing recovery was unfolding in many market across the U.S., including Orange County and the rest of Southern California.

From here, expect news of housing appreciation through the rest of 2012. There will be a resurgence in the building industry as building permits skyrocket (inevitable since major earth grading and infrastructure is already well underway throughout the OC). With the media communicating the healing housing market and appreciation, consumer confidence will rise with the knowledge that the “average Joe’s” biggest asset, his home, is moving in the right direction. Housing is the fundamental driver to the eventual healing of the economy as a whole. It has been that way with every modern downturn. Stay tuned…

Demand: As kids heads off to school, demand starts its cyclical slowdown.

The real estate market is transitioning into the Autumn Market. Yes, autumn does not officially begin until the end of September, but it comes early for housing every year. Buyers with kids want to close by the time school begins, so with that window gone, demand starts to slow from the highs of the spring and summer. Demand, the number of new pending sales over the prior month, dropped by 2%, 81 pending sales, and now totals 3,463. That is the highest level for this time of year since I started tracking demand back in 2004, and even exceeds 2009 when the initial first time home buyer tax credit artificially stimulated demand.

Currently, demand is still very close to 2009 numbers, but a major difference is that more short sales are actually closing today compared to back then. It used to be a crapshoot as to whether or not a short sale would ever close. Today, the odds are much more favorable, systems have improved, and short sales are eventually closing.

Last year at this time there were 414 fewer pending sales, a 14% difference. Demand may drop during the Autumn Market, but expect only a slight drop since the inventory is so tight and many buyers have been unsuccessful thus far in their attempts to purchase. For the persistent buyer with a sharp enough pencil and a lot of patience, success is inevitable in time.

By Steven Thomas

By Steven Thomas

Subscribe to:

Posts (Atom)